Your Partner in Export

and Import / Brexit

Customs Agency Langowski Logistics (*B2B only)

Comprehensive customs and freight forwarding solutions

for fast and trouble-free transport

to and from the UK after the BREXIT

REMINDER:

The transition period ended on 31 December 2020,

with which the United Kingdom finally left the European Union

and from 1 January 2021 is treated as a so-called third country.

WHY YOU SHOULD CHOOSE US

Langowski Logistics

Thanks to the prestigious AEO FULL certificate, we perform clearances in simplified customs procedures and we provide cashless VAT settlement in import. Our customers can also benefit from safety and security benefits when goods enter or leave the customs territory of the Community.

We are also the exclusive partner in Poland of the British Customs Clearance Consortium, which brings together both British entrepreneurs trading with European Union countries, as well as customs experts and logistics companies. This cooperation enables us to offer customs clearance also in Great Britain.

TRANSPORT TO AND FROM GREAT BRITAIN

What we offer

Simplified

customs procedures

The use of various

mode of transport

Warehouses

and bonded warehouses

Consolidations

shipments

Agent Network

all around the world

Comprehensive

customs clearance

Full customs clearance services for exports and imports to and from Great Britain.

We guarantee the legality of each transport, we provide the driver with appropriate documents, preventing additional costs and possible delays.

Customs clearance

directly at the customer

Thanks to the places recognised in our warehouses located in Gdańsk, Gdynia, Warsaw, and Łódź, we provide faster and efficient import and export service that does not require presenting the goods to the customs office. This applies to both general cargo and full container goods, importers, exporters and carriers.

We also offer the possibility of consolidating and deconsolidating loads in our warehouses as part of a transshipment hub.

Various branches

transportation

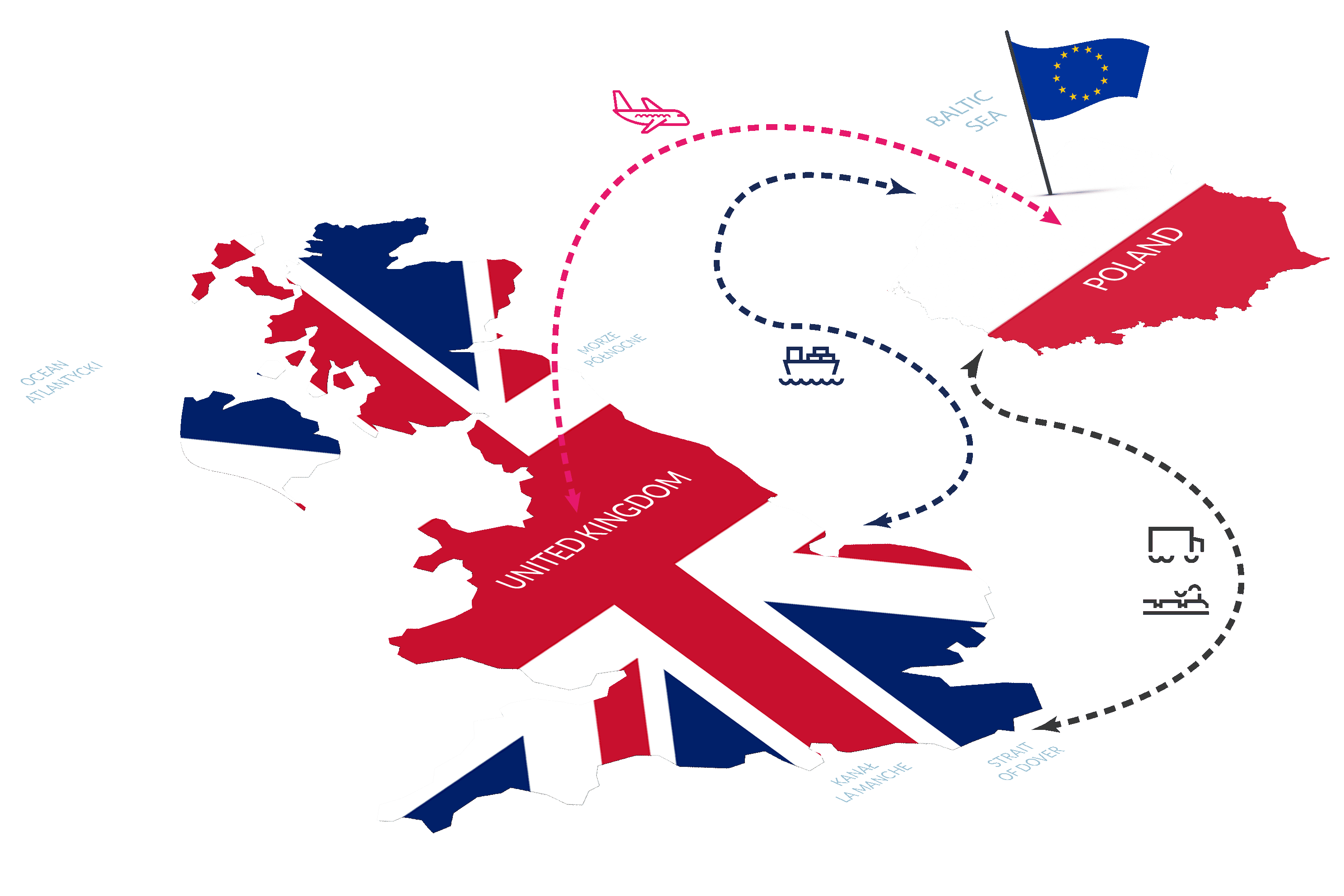

When carrying out transport from or to Great Britain, we offer a door-to-door service using road, sea, air and rail connections.

An optimally planned transport process can result in significant savings. For this purpose, we recommend intermodal transport using two or three separate modes of transport for the same load unit.

FAQ - General Information

1. Stages of introducing border control in the UK.

Rules for goods entering Great Britain:

Valid from 1st October 2021

- he requirement for advance notification of products of animal origin (POAO), certain animal by-products (ABP) as well as high risk non-animal food (HRFNAO) will apply from 1st October 2021. The same day, the requirements for an export health certificate for POAO and some ABPs will also come into force.

Valid until 1st January 2022

- Customs declarations will still be required and the use of deferred declarations, including submitting supplementary declarations up to six months after importing the goods, has been extended until 1st January 2022.

- Until 1st January, no security and safety declarations will be required for import.

- Physical SPS checks for POAOs and some ABPs and HRFNAOs will not be required until 1st January 2022. From then, they will take place at border inspection posts.

- Physical SPS checks at high priority establishments will continue at destinations until 1st January 2022. Then they will be transferred to border inspection posts.

Valid from 1st January 2022

- From 1st January 2022, the requirement for pre-notification, phytosanitary certification and documentary checks will be extended to all regulated plants and plant products.

Valid from 1st March 2022

- From March 2022, checks on live animals and all regulated plants and plant products, including those with low risk, will be carried out at border inspection posts.

2. What are the customs formalities related to the import / export of goods?

From 1st January 2021, Great Britain ceased to participate in the EU customs union (for Northern Ireland, which is still in force with EU customs regulations). On the EU side, with the exception of special arrangements, border customs authorities will carry out risk-based customs code controls applied to all other EU external borders. This applies to the movement of goods from and to third countries. To complete customs formalities, from 1st January 2021, entrepreneurs intending to import from / export to the UK should have an EORI trader identification number. EORI documents issued in the UK will no longer be valid in the EU. The same applies to the authorisations for authorised economic operators as well as those issued by the United Kingdom. A Polish entrepreneur wishing to obtain an EORI number should submit an application to PUESC www.puesc.gov.pl.

3. What are the tax and duty requirements?

Great Britain is no longer part of the customs territory of the Union and is treated as a third country. The Trade and Cooperation Agreement between the EU and the UK sets zero tariffs and trade quotas between the UK and the European Union. Exporters and importers are bound by proof of origin, application of the provisions on supplier’s declaration. This is a declaration by which the supplier of goods communicates to his customer information on their originating status in the context of preferential arrangements (e.g. free trade agreements) and their rules of origin. The recipient of the goods needs this information to establish and confirm the preferential origin of the goods. The preparation of such a document takes place without the participation of the customs authorities. The supplier is responsible for correctness. And while preparing them, there are a number of formal requirements. The rules for paying VAT on parcels sent to British buyers have also changed.

4. What certificates, permits, markings and labels do I need?

As of 1st January, the European Union and the United Kingdom constitute two separate regulatory and legal areas. So when placing goods on the UK market it is imperative that you comply with all relevant UK laws. On the territory of Great Britain, the documents of the European Union, so far required for road transport, such as transport licenses or drivers’ documents, are recognized. Another important right included in the Trade and Cooperation Agreement is the possibility to perform, on a reciprocal basis, transport to / from and through the territory of a third country, with or without transit, provided that the first loaded journey is performed (and the return journey may be laden or unladen). In principle, the requirements for market access and access to the profession are analogous to those of the European Union. This means that there will be no changes in this regard for Polish carriers and drivers. The main changes are border controls, new customs and phytosanitary procedures, as well as new rules for the organization of traffic at the EU’s external border with the UK.

5. How to improve transport, procedures and customs clearance?

Brexit raised a lot of questions and doubts, so settling all procedures and formalities requires years of experience. Therefore, we encourage you to contact us directly. We will be happy to help you with the export / import from / to Great Britain. Thanks to us, you will avoid the need to seal the goods, customs clearance will not require you to appear at the Customs Office each time, and we will support you in improving transport and undergoing all necessary procedures. Our support will not only help you shorten the delivery time, but will also relieve you of many formalities and the stress associated with it. Contact us: +48 58 355 73 98, brexit@langowski.eu.

IF YOU HAVE MORE QUESTIONS

Contact

Use our contact form and send us a request for proposal. Our sales department will send you an offer as soon as possible.